FURLOW BOOKKEEPING & TAX SERVICE

FURLOW BOOKKEEPING & TAX SERVICE

Tax Season Essentials

Move Forward with Certainty

Understanding Deductions

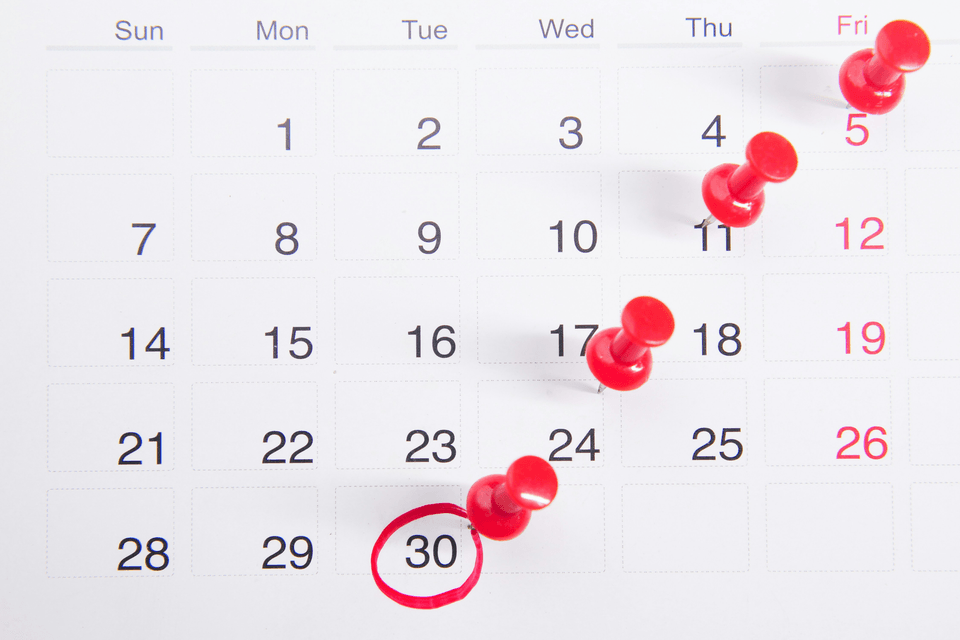

Deductions can significantly reduce your taxable income, but many taxpayers miss out on valuable opportunities. This guide explains common deductions, such as those for home office expenses, medical expenses, and charitable contributions. We also provide tips on how to keep accurate records to substantiate your claims, ensuring you maximize your refund while remaining compliant with tax laws.Filing Deadlines Explained

Staying informed about filing deadlines is crucial for avoiding penalties and interest on late payments. In this section, we outline important dates for individual and business tax returns, estimated tax payments, and extensions. We also share strategies to help you stay organized throughout the year, so you can file your returns on time without the last-minute rush.Common Tax Mistakes to Avoid

Many taxpayers fall into the same pitfalls each year, which can lead to costly errors and audits. This guide highlights the most frequent mistakes, such as incorrect information, missed credits, and failure to report income. By understanding these common issues, you can take proactive steps to ensure your tax return is accurate and complete, safeguarding yourself from potential complications.

Understanding Tax Brackets

How the tax brackets work

In the U.S. tax system, income tax rates are graduated, so you pay different rates on different amounts of taxable income. There are seven federal income tax rates in all: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. The more you make, the more you pay.

A tax bracket is a range of income that’s taxed at a specified rate. Importantly, your highest tax bracket doesn’t reflect how much you pay on all of your income. If you’re a single filer in the 22 percent tax bracket for 2025, you won’t pay 22 percent on all your taxable income. You will pay 10 percent on taxable income up to $11,925; 12 percent on the amount between $11,926 and $48,475; and 22 percent above that (up to $103,350)

In addition, the 2025 standard deduction will be $15,000 for single filers and $30,000 for married couples filing jointly, up from $14,600 and $29,200, respectively, for 2024. The standard deduction is the fixed amount the IRS allows you to deduct from your annual income if you don’t itemize deductions on your tax return. The lower your taxable income is, the lower your tax bill.

Smart Financial Strategies

Build Your Financial Future

Budgeting Basics

Creating and sticking to a budget is essential for effective financial management. This resource provides a step-by-step guide to developing a budget that works for you, including tips on tracking income and expenses. It emphasizes the importance of setting financial goals, whether short-term or long-term, and offers tools to help you monitor your progress and make adjustments as needed.Understanding Investments

Investing can be a powerful way to grow your wealth over time, but it can also be confusing for beginners. In this section, we break down the basics of investing, including different asset classes, risk management, and portfolio diversification. We aim to equip you with the knowledge to make informed investment decisions that align with your financial goals and risk tolerance.Retirement Planning Made Easy

Planning for retirement is crucial to ensure financial stability in your later years. This resource outlines key steps for effective retirement planning, from understanding different retirement accounts to estimating future expenses. We provide actionable insights into how much to save and when to start, along with strategies to maximize your contributions and investment returns for a secure retirement.